Sometimes a business reaches a stage where continuing operations is no longer possible or practical. This could be due to low profits, increasing debts, or the owners deciding to move on. Closing a business without proper planning can lead to legal troubles, unpaid debts, and unnecessary stress for everyone involved. In such situations, knowing the right process becomes important.

This blog will help you understand what is voluntary liquidation and why it’s the best way to close a company in such circumstances. It is a structured and legal process that allows owners to shut down their company in an orderly way. This approach helps pay off debts, settle accounts, and end business operations without chaos or legal risks. We will walk you through how voluntary liquidation works and why it’s the right choice in such cases.

What is Voluntary Liquidation?

Voluntary liquidation is a legal process where a company’s owners decide to close the business and sell its assets to pay off debts. Unlike forced liquidation, which happens when creditors or courts step in, voluntary liquidation is initiated by the company itself. This gives the business more control over the closure and ensures that everything is done in a planned and lawful manner.

The business is no longer profitable

When a company’s revenue consistently fails to cover its expenses, it becomes financially unsustainable. In such cases, voluntary liquidation allows owners to close the business in an organized way, avoiding unnecessary losses.

Owners want to retire or move on

Sometimes, liquidation is not about failure but about life changes. Owners may choose to retire, pursue new opportunities, or shift to another business venture. Voluntary liquidation provides a clean exit strategy.

Unable to pay debts but closing orderly

If a company is insolvent, meaning it cannot pay its debts, voluntary liquidation helps settle obligations fairly. This approach protects directors from potential legal issues and ensures creditors are treated according to the law.

Types of Voluntary Liquidation

Voluntary liquidation is not the same for every business. It depends on whether the company still has enough money to pay its debts or not. There are two main types of voluntary liquidation, and each has a different process. Knowing the difference helps business owners make the right choice and avoid future legal problems. The two types are Members’ Voluntary Liquidation (MVL) and Creditors’ Voluntary Liquidation (CVL).

Members’ Voluntary Liquidation (MVL)

This is for companies that are solvent, meaning they have enough assets to pay all debts in full within 12 months. Owners use MVL when they want to close the company for personal reasons, retirement, or restructuring. After paying off creditors, any leftover money or assets are distributed among shareholders.

Creditors’ Voluntary Liquidation (CVL)

CVL is for companies that are insolvent, meaning they cannot pay their debts. In this process, company assets are sold to repay creditors as much as possible. Once the assets are sold and funds are distributed, any remaining debts are usually written off, and the company is legally closed.

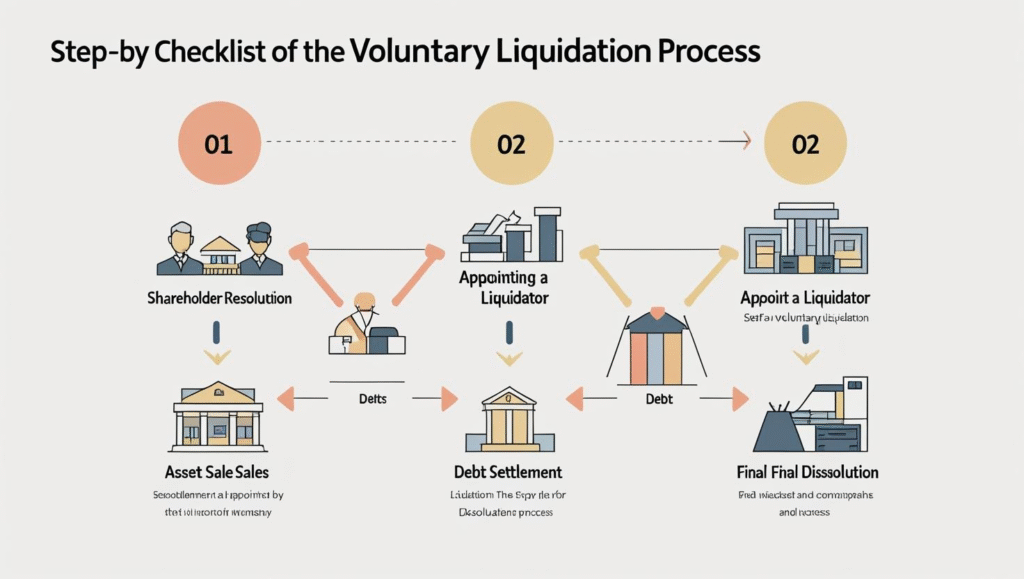

The Voluntary Liquidation Process Step-by-Step

Voluntary liquidation follows a legal process designed to ensure fairness to all parties involved. It gives creditors a clear way to recover what they can while allowing directors to close the company in a structured manner. Below is a breakdown of the main steps involved.

1. Board Resolution

The process begins with the company’s directors meeting to agree that the business cannot continue due to financial or operational reasons. They pass a formal resolution to recommend voluntary liquidation to the shareholders. This step also includes appointing an insolvency practitioner who will oversee the process and ensure everything is done legally.

2. Shareholder Approval

After the board’s decision, shareholders vote on the liquidation. For the process to move forward, at least 75% of the shareholders (by value of shares) must agree. This approval gives the insolvency practitioner the authority to act and officially start the winding-up process.

3. Appointment of Liquidator

Once approved, the insolvency practitioner becomes the official liquidator. Their role is to take control of the company’s assets, deal with creditors, and manage all necessary paperwork. The liquidator also communicates with creditors to explain the process and provide updates.

4. Asset Realisation

The liquidator identifies all company assets, such as property, vehicles, inventory, or intellectual property, and sells them to raise funds. This step aims to maximise the value of the assets so that creditors can receive as much repayment as possible.

5. Payment to Creditors

Funds raised from asset sales are distributed to creditors according to a legal priority order. Secured creditors, such as banks with collateral, are paid first. After that, payments go to unsecured creditors, employees (for unpaid wages), and finally shareholders if any funds remain.

6. Company Dissolution

After all debts are addressed and reports are filed with the relevant authorities, the company is officially dissolved. At this stage, it is removed from the corporate register, meaning it no longer legally exists.

Benefits of Voluntary Liquidation

Closing a company is never an easy decision, but choosing voluntary liquidation has some clear advantages. It allows business owners to take charge of the situation rather than waiting for things to spiral out of control.

1. Control over the process

In voluntary liquidation, the directors and shareholders decide when to start the process and who will manage it. This means you can plan the closure at the right time for your business, rather than being forced into it by a court order. Having this control also helps you prepare documents, notify employees, and manage assets in a more organised way.

2. Reduced legal risks

If a company is insolvent but keeps trading, directors may face serious legal trouble for wrongful or fraudulent trading. By choosing voluntary liquidation early, you show that you are acting responsibly. This reduces the chance of investigations, fines, or bans from being a company director in the future.

3. Better relationships with creditors

When a business is transparent about its financial problems and takes proactive steps to close down, creditors usually respond more positively. They are more willing to cooperate and agree to repayment plans because they see you are trying to treat them fairly. This can also help protect your personal and professional reputation.

4. Cleaner financial closure

Voluntary liquidation ensures that all company debts, contracts, and obligations are dealt with according to the law. The insolvency practitioner will handle asset sales and distribute the money fairly among creditors. This way, there’s no leftover debt or legal disputes hanging over you after the company is closed.

5. Emotional relief

Running a failing business can be extremely stressful. Voluntary liquidation provides a clear end point, which can help you let go of the constant pressure and uncertainty. Many directors feel a weight lifted once the process begins, allowing them to focus on new opportunities or rebuild their careers without the burden of old debts.

Risks and Challenges of Voluntary Liquidation

While voluntary liquidation has benefits, it also comes with certain risks and challenges that business owners should be ready for.

1. Personal guarantees

Sometimes, company directors or owners personally guarantee a loan or lease. This means they promise to pay it back if the company cannot. Even after liquidation, these personal guarantees still apply. For example, if you are guaranteed a bank loan, you will need to pay it yourself if the company’s assets don’t cover it.

2. Loss of control

Once a liquidator is appointed, the directors no longer make business decisions. The liquidator takes over all control of the company’s affairs, bank accounts, and assets. This can be difficult for owners who are used to managing their business themselves.

3. Potential investigations

If the company is insolvent (cannot pay its debts), the liquidator must investigate the company’s past activities. This includes checking if directors followed the law, avoided wrongful trading, and acted in the best interest of creditors. Any suspicious activities could lead to legal action.

4. Financial loss

Business owners may lose the money they invested in the company. If the company’s assets sell for less than expected, there may not be enough to pay all creditors. In such cases, owners do not receive any leftover funds.

Legal Requirements and Documentation

When a company chooses to close through voluntary liquidation, it must strictly follow the steps required by law. These rules are designed to protect the rights of creditors, shareholders, and employees, and to ensure that the process is fair and transparent.

If these legal requirements are not met properly, the liquidation can face serious problems such as unnecessary delays, financial penalties, or even court action. That is why it is important for company directors and shareholders to fully understand their obligations before starting the process.

1. Passing a shareholder resolution

The company’s shareholders must formally agree to close the business. This is done by holding a meeting and passing a special resolution. In most cases, at least 75% of the shareholders must vote in favour.

2. Filing the resolution with the company registry

Once the resolution is passed, you must submit it to the official company registry in your country. This ensures the closure process is officially recorded.

3. Appointing a licensed liquidator

A licensed liquidator is a professional responsible for selling company assets, paying off debts, and ensuring the process follows the law. They take over control of the company from the directors once appointed.

4. Preparing a statement of affairs

In a Creditors’ Voluntary Liquidation (CVL), the directors must prepare a detailed financial report called a “statement of affairs.” This document lists all company assets, debts, creditors, and other financial details, so creditors know the company’s true financial position.

5. Publishing official notices

You must publish notices in official government gazettes or newspapers to inform creditors, employees, and the public about the liquidation. This step ensures transparency and gives creditors a chance to submit their claims.

By completing these legal steps correctly, you avoid unnecessary legal trouble and ensure the liquidation is valid under the law.

Alternatives to Voluntary Liquidation

Before choosing voluntary liquidation, companies should know there are other ways to handle financial or operational problems. These options might help keep the business running or sell it in a better way. Here are some common alternatives:

1. Company restructuring

Instead of closing, a company can negotiate with its creditors to repay debts over time. This process, called restructuring, allows the business to adjust payment plans and reduce financial pressure. It helps the company continue operating while fixing money problems.

2. Selling the business

If the owners want to exit but don’t want to shut down completely, they can try selling the company. A buyer might take over the business, including its assets and contracts, keeping it alive. This option can sometimes give owners a better financial outcome than liquidation.

3. Merging with another business

Two companies can combine to form one stronger business. A merger can reduce costs, share resources, and create new opportunities. If your company is struggling, joining with a healthier business could help save jobs and keep the business going.

4. Administration

Administration is a legal process where an external expert temporarily takes control of the company. The goal is to fix problems and avoid closure by reorganizing the business or finding new buyers. It offers a chance to recover and continue trading rather than closing down.

Choosing the right alternative depends on your company’s situation. It’s important to get professional advice before deciding, so you can find the best solution for your business and its future.

Common Myths About Voluntary Liquidation

Many people have wrong ideas or misunderstandings about voluntary liquidation. These myths can cause unnecessary worry or confusion. Let’s look at some common myths and explain the truth behind them:

Myth 1: Only Failed Businesses Choose Liquidation

Some people think that liquidation means a business has completely failed. But that’s not always true. Many companies that are doing well financially use voluntary liquidation as a planned way to close the business. For example, owners might want to retire, sell the business, or simply move on to new projects. In these cases, voluntary liquidation helps them close the business in an organized way, often with tax benefits.

Myth 2: Directors Lose Everything

It’s a common fear that directors or owners will lose all their personal money and property if the company goes into liquidation. However, this usually isn’t the case. Directors only lose personal assets if they have signed personal guarantees for company loans or debts. Otherwise, their personal belongings, savings, and homes are protected. Liquidation affects the company’s assets, not the director’s personal assets.

Myth 3: Liquidation Ruins Your Reputation

Some people worry that if a company is liquidated, it will hurt the directors’ or owners’ reputations forever. In reality, if the liquidation is handled properly and with honesty, it can actually show that the business leaders acted responsibly. They took steps to close the business legally and fairly, paying creditors and following the right procedures. Many professionals understand this and do not judge a director negatively just because of liquidation.

Myth 4: Liquidation Means Bankruptcy

Liquidation does not always mean the company is bankrupt or broke. In Members’ Voluntary Liquidation, the company is solvent and can pay all its debts. The business is simply closing down on its own terms. Bankruptcy happens only if the company cannot pay its debts.

Myth 5: Liquidation Is Always Quick and Easy

While liquidation can be straightforward in simple cases, it often involves many steps, paperwork, and legal rules. It takes time to sell assets, settle debts, and complete the process. This means owners should be prepared for a process that can take months and requires careful planning.

Understanding these myths can help business owners feel more confident and informed when deciding about voluntary liquidation. It’s always best to get advice from professionals who can guide you through the process clearly and fairly.

Final Thoughts

Voluntary liquidation is not always a sign of failure. For many businesses, it’s a smart, planned way to close down and move forward. By understanding the process, types, costs, and benefits, company owners can make an informed decision and avoid unnecessary stress.

If your company is struggling or you’re planning an exit, speaking to a licensed insolvency practitioner can help you choose the right path. The earlier you get advice, the more options you’ll have. Taking the right steps early on can make all the difference in protecting your interests and ensuring a smooth transition.