Liquidation in accounting may sound technical, but it’s something many people wonder about. Have you ever thought about what happens when a business can’t pay its bills anymore or why some companies suddenly shut down after years of running?

The answer lies in a process called liquidation. It explains how a business closes down and settles its debts in a clear and structured way. Understanding how liquidation works in accounting can give you a better picture of what really happens when a company shuts its doors.

What is Liquidation in Accounting?

Liquidation in accounting is the process of closing a business in an organized way. The company sells its assets, like equipment, property, or cash, to pay off debts owed to creditors, suppliers, and employees. This ensures that everything is settled fairly and the business ends with clear financial records.

Key Points About Liquidation:

- Organized closure: Businesses don’t just shut down; they follow proper steps.

- Asset conversion: Items like office equipment, property, or inventory are sold to generate cash.

- Debt repayment: Creditors, suppliers, and employees are paid in a specific order.

- Clear records: All transactions are documented, so nothing is left unclear.

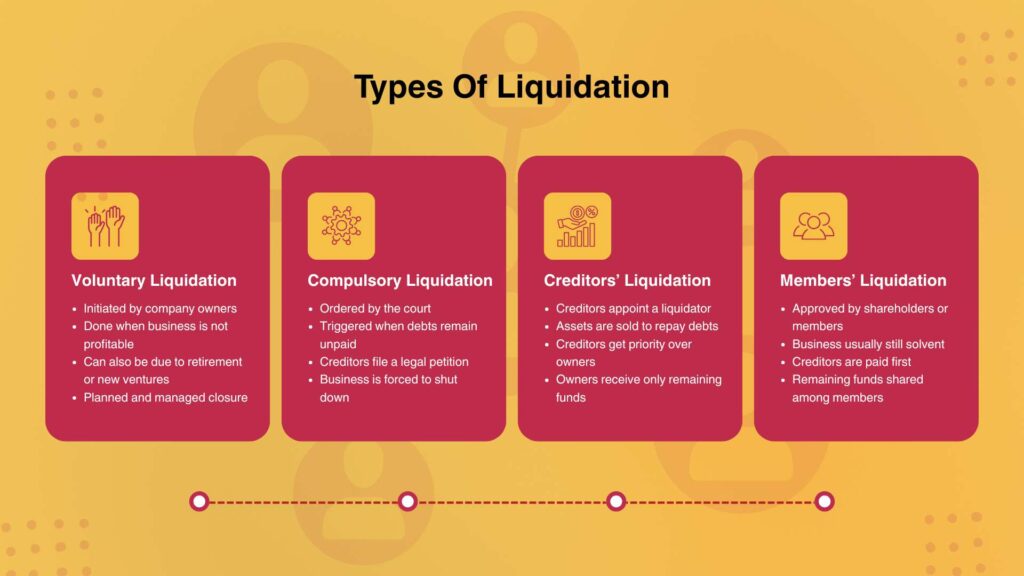

Types of Liquidation in Accounting

Businesses can go through liquidation in different ways depending on the situation. Here are the main types:

1. Voluntary Liquidation

This happens when the owners of a company decide to close it themselves. Reasons can include:

- Initiated by company owners

- Done when business is not profitable

- Can also be due to retirement or new ventures

- Planned and managed closure

2. Compulsory Liquidation

This occurs when a court orders a business to close. Usually, this happens if:

- Ordered by the court

- Triggered when debts remain unpaid

- Creditors file a legal petition

- Business is forced to shut down

3. Creditors’ Liquidation

This occurs when a court orders a business to close. Usually, this happens if:

- Creditors appoint a liquidator

- Assets are sold to repay debts

- Creditors get priority over owners

- Owners receive only remaining funds

4. Members’ Liquidation

This occurs when a court orders a business to close. Usually, this happens if:

- Approved by shareholders or members

- Business usually still solvent

- Creditors are paid first

- Remaining funds shared among members

How Liquidation Works in Business

When a business goes into liquidation, it follows a clear process to close everything properly.

Step 1: Appointing a Liquidator

A liquidator is a professional who manages the closure. They make sure assets are sold, debts are paid, and records are accurate.

Step 2: Selling Assets

All company assets, like equipment, property, inventory, and cash, are sold. The money collected is called the realization of assets.

Step 3: Paying Off Debts

The money from the sale of assets is used to pay off all debts. Employees, creditors, suppliers, and government dues are settled first, and any remaining funds are returned to the owners or shareholders.

Step 4: Closing Legal and Financial Records

Once debts are cleared, the liquidator completes final reports and submits them to authorities. The company is then officially removed from the business registry.

Step 5: Final Distribution

Any remaining funds after all payments are made are distributed to the owners or shareholders. This marks the official end of the business.

Reasons Why Businesses Go Through Liquidation

Businesses may face liquidation for several reasons. Often, continuous financial losses make it impossible to keep running. Some companies struggle with unpaid debts or poor cash flow, making it hard to pay employees and suppliers. Changes in the market, unexpected expenses, or mismanagement can also force a business to close. Liquidation helps settle everything in an organized way rather than leaving problems unresolved.

How Liquidation Affects Businesses and Everyone Involved

Owners

Business owners often lose their investment when a company is liquidated. Any remaining funds after paying debts are usually the only money they get back.

Employees

Employees may face job loss and uncertainty about unpaid salaries or benefits. Liquidation ensures they are paid before other creditors.

Creditors

Creditors are the people or organizations the business owes money to. Liquidation helps them recover as much of their money as possible from the sale of assets.

Customers

Customers who have pre-paid for products or services might face delays or cancellations. Knowing about liquidation helps them manage expectations.

How Businesses Can Avoid Liquidation

Businesses don’t have to reach liquidation if they plan carefully. Keeping track of finances, managing cash flow, and paying debts on time can prevent many problems. Regular audits and professional accounting advice help owners spot issues early. Smart planning, cutting unnecessary expenses, and preparing for market changes can save a company from facing liquidation altogether.

Frequently Asked Questions

In accounting, the purpose of liquidation is to close a business in an organized way while keeping clear financial records. It ensures all debts are settled properly and the process is transparent for owners, creditors, and employees.

Liquidation is neither inherently good nor bad. It’s a process to settle a business properly. While it may seem negative because the company closes, it ensures debts are paid and accounting records are accurate.

The three main types are:

- Voluntary liquidation – When owners decide to close the business.

- Compulsory liquidation – When a court orders the closure.

- Creditors’ liquidation – When creditors take control to recover their money.

Liquidation is calculated by adding the value of all company assets and then subtracting the debts owed. Accountants keep detailed records of these calculations to ensure accurate distribution to creditors and owners.

When a company is under liquidation, a liquidator manages the process. Assets are sold, debts are paid, and accounting records are finalized. The business officially closes once all financial and legal steps are complete.

Conclusion

Liquidation in accounting is a way to close a business fairly, settle debts, and keep clear records. Understanding it helps owners make smarter financial decisions and plan ahead. With proper accounting and timely action, companies can avoid liquidation and focus on growth and stability. Capital Closure can guide businesses through the process and ensure everything is handled correctly.