When a company goes into liquidation, many directors begin to worry about what this means for them. They often ask if they will lose control of the business or be forced to pay the company’s debts from their own money. This can feel stressful and confusing when the company is already in trouble.

The truth is, liquidation does not always end badly for directors. Their role may change, but they still have rights and options. By understanding what happens during the process, directors can protect themselves, make better choices, and prepare for future opportunities.

Understanding the Role of a Director of a Company During Liquidation

When a company goes into liquidation, the director’s role changes in big ways. They no longer run the business or make daily decisions. Instead, they are expected to support the liquidator and help the process move forward smoothly.

What liquidation really means for directors

Liquidation means directors no longer manage the company. Once the process begins, control shifts to a licensed liquidator who handles assets, pays creditors, and manages the closure. The director’s part is to share accurate records, give honest details, and support the liquidator so the process runs smoothly.

How a director’s powers and control change during liquidation

Directors lose their decision-making powers once liquidation starts. They cannot trade, sell assets, or sign contracts for the company. Instead, they must cooperate with the liquidator by answering questions, attending meetings if needed, and providing information to help complete the process in a fair and legal way.

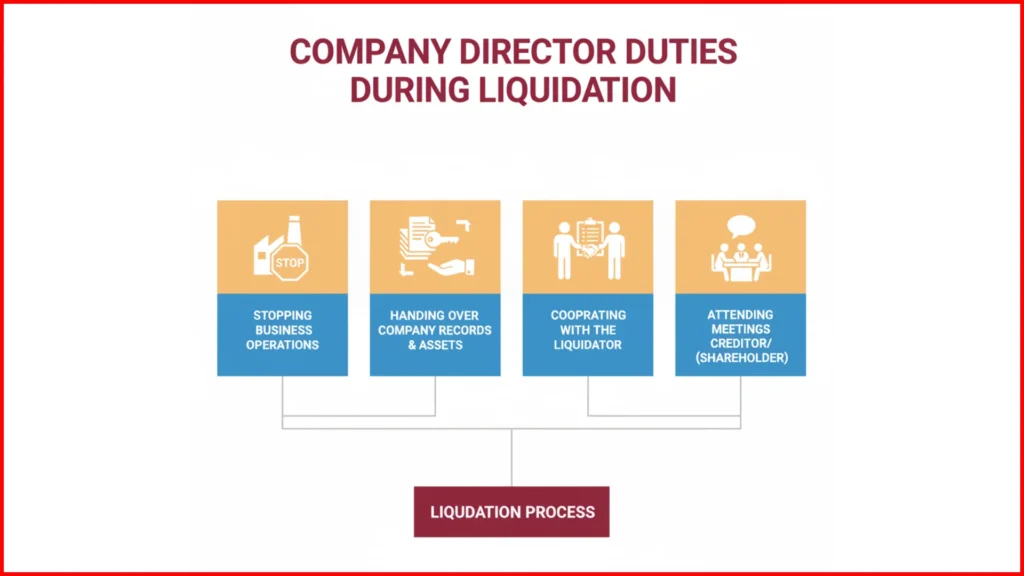

Responsibilities of a Director During Liquidation

When a company goes into liquidation, a director’s role does not disappear completely. Instead, their responsibilities shift from running the business to supporting the liquidator. These duties are important because they ensure the process is carried out smoothly and fairly for everyone involved.

Stopping business operations

Once liquidation begins, directors must stop all business activity. They cannot trade, sign new contracts, or make financial decisions on behalf of the company.

Handing over records and company assets

Directors must give the liquidator full access to financial records, bank details, and company property. This ensures the process is carried out fairly.

Cooperating with the liquidator

Directors have to answer questions, share information, and provide support whenever asked. Full cooperation helps avoid delays and builds trust in the process.

Attending creditor or shareholder meetings

Directors may be asked to attend meetings with creditors or shareholders. These meetings allow the liquidator to explain progress and give updates on how debts will be handled.

Legal and Financial Risks Directors May Face

Can a director be personally liable for company debts?

In most cases, company debts remain separate from the director’s personal money. But if directors gave personal guarantees for loans or credit, they may still need to repay those amounts even after liquidation.

Wrongful or fraudulent trading investigations

If a director keeps trading when they know the company cannot pay its debts, this may be seen as wrongful trading. In serious cases, it can even be called fraud. Both can lead to legal action and personal liability.

Possibility of being sued by creditors

Creditors may take legal action if they believe a director acted unfairly or broke their duties. This is why it is important for directors to be honest, keep proper records, and act in the best interest of creditors during liquidation.

Director’s Future After Liquidation

Liquidation changes a director’s role, but it does not always mean the end of their business journey. Many directors continue with new opportunities, though some rules and limits may apply.

Can a Director Run Another Company After Liquidation?

Yes, most directors can start or manage another company once liquidation is finished. They are only stopped if the court bans them for serious mistakes like fraud or wrongful trading.

Restrictions and Disqualifications Directors May Face

Sometimes directors may face limits after liquidation. They might be banned from managing companies for a number of years or told not to use the same company name again. These rules are in place to protect creditors.

What Happens if There Are Multiple Directors?

If a company has more than one director, all of them must follow the same rules. Each director has to work with the liquidator and provide the right information. If one director does not do this, they may face action on their own.

How Directors Can Protect Themselves During the Process

Directors may feel worried during liquidation, but there are steps they can take to stay safe and avoid future problems. Acting early, being honest, and keeping things clear can make the process much easier.

Seeking early advice

The best step a director can take is to ask for professional advice as soon as financial problems appear. Waiting too long often makes things worse. An expert can guide directors on whether to restructure, sell the business, or begin liquidation in the right way. Early action shows that the director is acting responsibly.

Keeping records clear

Directors should make sure all company records are accurate and up to date. This includes bank statements, contracts, employee records, and tax filings. Good record-keeping proves that the director acted in good faith and makes the liquidator’s job much easier. Missing or false records can raise doubts and even lead to investigations.

Acting in the best interest of creditors

Once liquidation starts, directors must think about creditors first. They should avoid taking money out of the business for personal use and should not favor one creditor over another. Working with the liquidator to recover as much as possible shows honesty and reduces the risk of legal problems later.

Directors are not usually responsible for company debts. But if they gave personal guarantees or acted in the wrong way, they may need to repay some money.

Once liquidation begins, directors lose control of the business. A liquidator takes over, and directors must hand over records, answer questions, and support the process.

Yes, in most cases directors can manage another company after liquidation. The only time they cannot is if the court bans them for serious misconduct.

Yes, if a director is found guilty of fraud, wrongful trading, or poor conduct, they may be banned from running any company for several years.

Personal assets are usually safe. They are only at risk if the director gave personal guarantees for company loans or used company funds in the wrong way.

Conclusion

Liquidation can feel like a heavy process for directors, but it does not always mean the end of their business future. While their role changes and risks may exist, directors still have rights and ways to protect themselves. By knowing their duties, keeping records clear, and acting in the best interest of creditors, they can move through liquidation with confidence.

At Capital Closure, we guide directors through every step of liquidation. From handling paperwork to explaining responsibilities, our team makes the process easier and less stressful. With the right support, directors can close this chapter and prepare for new opportunities ahead.